The aim is simple, to deliver performance of 20-25% per annum over the medium term in USD$ to our investors. We do so by managing a focused portfolio of circa 20-25 best idea listed securities in which every stock has the potential to deliver a meaningful contribution to the portfolio’s return. Risk management is at the heart of all investment decisions, and we look for asymmetric opportunities with significant upside and limited downside. We combine this with sensible diversification across sectors and themes.

In a growth market such as India, most funds are likely to do well over the long term in our view, including ETFs and daily traded active funds. However, we believe that Cohesion MK Best Ideas has significant benefits over both. When comparing the fees in each, the net returns delivered to investors are the ultimate test and we have comfortably outpaced both

indices and peer groups, net of fees, since launch.

By design, an ETF will have exposure to every company in its reference index. That will include companies that look overpriced, or which have poor fundamentals or weak management. In an inefficient market such as India, it is possible to find companies that are growing far faster than the market, and which are simultaneously much cheaper than the market. This is demonstrated by our PEG ratio which is a fraction of that of the MSCI India Index. As indices are typically market capitalisation based, an ETF will typically have much greater exposure to giant companies. Although there are always some large caps that we like and hold, there are far more where we feel that they are likely to be a great company but not a great investment.

Access is a key part of our investment philosophy. We often receive generous allocations to sought after IPOs and other placings. ETFs and international asset managers are regularly frozen out of these and have to buy in the secondary market, often at a substantial premium.

ETFs and other actively managed mutual funds usually have daily liquidity. This is sometimes portrayed as an advantage to investors. We do not agree with this view. By allowing other investors to enter and exit a fund with no warning, fund managers can be put under pressure to trade far more frequently than they would like. Sometimes they will be selling favoured stocks to meet redemptions, only to buy the same stock back a few days later with fresh cash. This ultimately erodes the returns of longer-term investors. We undertake the most intensive due diligence on all of the investments that we make and having a greater degree of stability and clarity of our cash position allows for unhurried investments.

The core investment philosophy is based on GARP (growth at a reasonable price), margin of safety and information asymmetry. There is clearly an overlap between each aspect of the philosophy. When buying shares that are good value, you are likely to have more upside when things go well than downside if things don’t go to plan and thus there is a natural margin of safety. The process is also very intensely research driven with every opportunity being examined through multiple lenses, speaking not only with company management, but also with key suppliers, customers and competitors. Access is clearly crucial to this as many buy-side investors would not be able to speak to the right people to get this 360° expert view. We are also very aware of themes as these can play a big role in the market’s perception (and hence pricing of a company). Entire themes and sectors can go in and out of favour and it is important to be able to identify catalysts for these shifts. We have made a lot of money from identifying themes that were likely to play out over the coming months and years, brought about by changes in regulation, technology or shifts in the supply and demand landscape of an industry.

To an extent, value and growth are two sides of the same coin when you are a GARP investor. We don’t think it’s sensible for an investor to say that they are happy to buy growth at any price, nor to say that they will buy terrible businesses so long as they are cheap enough. In some markets, you are forced to buy growth at ridiculously high multiples because that’s all that’s available and in other markets you are forced to choose the best from a sector of declining companies. In India, the majority of the almost 8200 stocks will be enjoying growth most of the time and all we have to do is pick the 25 that represent the very best value with a catalyst.

Momentum is an important part of our investment process. We do not attempt to go against the flow and invest in companies that are getting worse, even if they appear cheap. We are particularly interested in earnings and news flow momentum. This doesn’t necessarily mean that there is analyst revision momentum as you may find in the West. A lot of the best companies have got little analyst coverage and therefore we can’t always rely on sell-side analyst upgrades. However, by undertaking our own extensive buy side research, we believe we can maximise our chance of identifying when a company is likely to go on a streak of

beating expectations, causing other investors to start upgrading their forecasts. Undervalued companies, which start beating expectations or delivering positive commentary is a very powerful combination and can lead to very rapid share price appreciation.

Our strategy is based on delivering maximum risk-adjusted returns and dividends can form a part of that consideration, but it is not a major part of our philosophy. As India is so clearly a growth market, most companies would rather invest their surplus cash into growing their businesses.

The basic philosophy of the fund remains intact during all phases of the market. It’s important to maintain discipline and not become too timid during periods of volatility or two exuberant when markets are roaring up. Both are classic mistakes that less experienced investors can make. In a market downtown, we can be given the opportunity to invest in high-quality companies that are being jettisoned by fearful investors. For that reason, we do not fear market volatility, which happens in every market around the world, we embrace it.

The fund’s core strategy is to invest into high-quality compounders. Due to the powerful long-term structural tailwinds in the Indian economy, there are a myriad of companies which are likely to see revenue growth of 10-30% year after year for decades. As a fund manager it is great to be able to own shares that every year are far more likely to rise rather than fall.

However, in addition to this core, there is also a great deal of opportunity to add value using short term tactics. Firstly, due to our access and relationships with key stakeholders, we’ve been able to secure preferential allocations to the hottest IPOs. This has allowed us to make profits of 50% plus in a very short period. We’ve also been able to pick up good quality shares from distressed sellers and make excellent short-term returns. Even with our favoured long-term holdings, we always have one eye on the short term. Great companies can become overvalued, and we are not averse to selling into strength. We can always return to these later if market volatility creates weakness. We are also conscious about short term momentum. Share prices can be very influenced by news flow and earnings momentum. Therefore, we pay particular attention to the likely direction of these over the next six months.

Madhu Kela and his team are all seasoned investors and have been through many cycles, including macrocycles such as interest rate rises and falls, political changes and changes to currencies and commodity prices. They are also keenly aware of the micro cycles which affect particular sectors such as the regulatory cycles that can affect banking or pharmaceuticals. One of the key strengths of the investment team is their ability to identify when there is a real cycle in play but other investors have either under or overestimated its importance. We often find that investors are “still fighting yesterday’s battle” and worrying

about things which are or will soon be in the rearview mirror.

This approach can be seen in our performance. Whilst we are proud of how much money wemade in 2020, 2021, 2023 and 2024, we are perhaps most proud of protecting capital in 2022 when asset markets around the world were generally very poor.

As we know, tax is one of the two certainties in life, and that’s the same in every country around the world. Tax rates do change in every country. Whilst India is not immune from tax rate changes, we believe that India is in better placed than many major Western economies. India’s balance sheet is in far better shape than most developed and emerging nations and it is also looking forward to decades of increasing prosperity and a young population. This gives the fiscal authorities some flexibility. Compare this with Western economies that have ever growing debt burdens and a greying population. With regards to specific investment opportunities, tax is considered as part of each decision to identify whether specific tax changes will benefit or harm a particular company or sector.

Geopolitical tensions affect every market. There is no way of getting away from these, regardless of the market in which you invest. Often, they create short-term volatility, which can be profitably used to buy from the fearful. Looking back on a 20-year performance chart of Madhu Kela, we can see tiny little blips that seemed enormously important and worrying at the time but are now almost irrelevant. At the time, these were front page news events that temporarily knocked 5% off markets but people who bought at these times would have been well rewarded. We believe India has one of the most favourable geopolitical positions in the world today.

We don’t regard trade agreements as being a threat. India is now a major trading partner for every country. In terms of its population, GDP or stock market, it’s more like a continent than a single country with a population approaching 1.5bn (there are about 750m people that live in Europe, a little over 1bn in North America and Latin America combined and 1.4bn in Africa). Quite simply, no trading partner has got the ability or desire to try to impose poor terms onto such an important partner. There will be new agreements that appear from time to time, and the Indian government is always looking for opportunities to enhance its growth. It is already the “office to the world” and has ambitions to be the “factory to the world” as well. When it sees the chance to cement these positions, the Indian government will propose and enter into new agreements, but it is doing so from a position of strength. The team have excellent on the ground knowledge of how such agreements will impact different sectors and can tilt the portfolio to maximise our benefit from them.

In our view, there is simply no substitute for proper buy-side research. The level of research that we undertake is akin to that found in a leading private equity house. We want to look at every investment through every possible lens, because the conversation with a regulator, competitor, supplier or customer can show the same company in a very different light. Even very simple grassroot techniques such as going to visit a company at different times of the day to see how busy they are or going to tradeshows and speaking to a wide range of delegates can present amazing insights. A lot of fund managers only bother to read sell-side research notes or marketing documents, and they get a very myopic view.

Often, great ideas can come to us when we aren’t looking for them. We may be out looking at company A, but then we hear a little snippet about company B who has an interesting product or service, which is revolutionising a part of the world. We can think of countless times when one of our investing companies has been proudly telling us that they have implemented a new system that is giving them maximum efficiency gains. Our immediate thought is “We need to speak with the company that makes this!”

The investment team has an insatiable desire for knowledge. For them, investment is far more than a job or career.

We keep up-to-date on the same newsfeeds that everyone else reads. It’s important to read all the mainstream market, economic, and social feeds because these are being read by other investors and influencing what they buy and sell. However, we make sure we always test these mainstream views by using specialist knowledge. Basically, we keep asking ourselves and others, “this is what the world is thinking, but to what extent is it true?” This is where the network of contacts, nurtured over 30 years, is invaluable.

There can be no doubt that India is growing fast and is forecast to deliver more growth in the next few years than it has done during its entire history.

In general, GDP growth around the world is driven by two things – population growth, and efficiency. Put simply, “how many people do you have producing things and how many things are they each producing”. India is in a fantastic position in both regards

Unlike most Western economies, and even China – once regarded as one of the world’s economic engine rooms - India has a young and fast growing population, adding 10-20m net new people every year. This is not a temporary phenomenon. This population growth is forecast to remain for several decades at least. Importantly, this is also the right sort of population growth. Anyone who has spent time in India will have been impressed by the fierce drive and determination. Ambition and hard work are woven into Indian culture. They simply want to get on and provide a better standard of living for them and their family, and when you have over 1 billion people sharing the same work ethic, amazing things can happen. We are also seeing efficiency gains throughout the Indian economy. When you provide 1.5 billion people, with an average age of 28, improving technology and digitisation of their economy, combined with a significant supply in new infrastructure, this will drive considerable gains in productivity.

We know that a lot of the world’s leading manufacturers have relocated large parts of their supply chain to India, in recognition of the fact that Indian managers are just very good at getting stuff done efficiently and well. Apple manufacturing the iPhone in India at scale is a great example of this. India is sure to be a leading adopter of AI. All of this bodes very well for decades of GDP growth. In addition, there are multiplier effects at work in the Indian economy. As an Indian family gets a high-paying salary in urban areas, they are able to spend that salary on a wide range of consumer goods and services, boosting demand in

many shops, offices, and factories, which in turn can provide higher salaries for other workers as these companies expand to meet the rising demand. Thus, every extra rupee that is generated through one new middle-class job will be multiplied several times as it ripples through the economy.

With Prime Minister Mr Narendra Modi having been re-elected for a historic third term and forming a comfortable majority with his longstanding political allies, we believe he has a clear mandate to continue with the reforms that he has already successfully implemented over the last decade. He has maintained a very pro-growth manifesto, promoting “Brand India” throughout his time in office and we expect this to continue.

Whilst Mr Modi is undeniably important to the India story, it is worth remembering that economic reforms have been underway since 1991, and Mr Modi has in many cases only accelerated changes that had already been in place for more than twenty years and before he was elected in 2014. Hundreds of millions of Indians have enjoyed a transformation in their daily lives due to these reforms. Although no political party anywhere in the world has universal acclaim, there is a widespread recognition that the reforms have been good for the vast majority of Indians and a powerful desire for them to continue.

In the short term, GDP and stock markets are not particularly well correlated. This applies to every stock market in every country. In the US they talk about the difference between “Main St and Wall St”. It is perfectly possible for them to be going in different directions because of a multitude of other factors. However, over the long term the price of an individual stock is likely to be correlated to its earnings growth, and as stock markets are an aggregate of individual companies, stock markets have a correlation with earnings. It follows that countries that have strong GDP growth are likely to provide the best opportunities for companies to grow their revenues and profits. India, which has experienced consistently strong GDP growth for many years, has been able to deliver much greater stock market growth for investors and yet still look attractively valued. Leading investment banks and economists are forecasting that this GDP growth will continue and even accelerate over the coming years with both the economy and stock market creating more growth in the next decade than in their entire history. It is inevitable that investors will compare the valuations of Indian companies with their Western peers. It is sometimes noted that Indian companies are

trading on PE ratios that are comparable and even higher compared to companies in the West. However, a simple PE ratio fails to reflect the greater growth in the Indian stock and also the far greater certainty of this growth. When PEG ratios are considered, Indian stocks look much better value. It is also important to remember that widely quoted P/E ratios reflect the index as a whole. As we are looking for 20-25 companies out of a market of nearly 8200 stocks, we are able to cherry pick those which are cheaper than the market and growing much faster than the market.

Every economy has exposure to global macro economics, with the exception of truly closed economies such as North Korea. That is true regardless of where you invest in the world. We should really divide such influences into two distinct parts. In the very short term, the Indian market, like every other market, will be jostled by international news. It’s entirely possible that a comment from the Fed, a non-farm payroll number or OPEC meeting could cause the Indian market to rise or fall a couple of percent in sympathy with all of the markets overnight. However, India is its own massive country being driven by factors which are far larger. The fact that the US Fed decide to push-up its interest rate doesn’t mean that India must follow suit or indeed do anything at all. Anyone who waits until there is complete certainty about all global macro factors will never invest in India and is likely to miss out on decades of super normal growth.

Each sector in India will, of course, be driven by its own specific factors; factors which are very well understood by Madhu Kela and his team. Their massive network of industry contacts are an invaluable source and serve as an early indication that a sector’s fortunes are about to change, often well before such changes are noticed by the investment community at large. One thing that sets India apart from comparable industry sectors in the West is that growth can be found in unexpected places.

Sectors which are commonly thought of as ex-growth in the West, such as construction and manufacturing can provide rich pickings for investors in India because they have strong tailwinds behind them. Naturally, there is cyclicality in some sectors in India, just as with the sectors globally, but Madhu Kela and his team are well aware of these and careful to adjust the valuations for such cyclicality.

No, whilst we mostly invest into secondary markets, we have made a great deal of money investing into IPOs and other new issuances. It is testament to how our investment adviser team led by Madhu Kela is regarded that companies have even structured and issued brand-new securities in order to have us on their share register. It is not unusual to see share prices rise substantially after it is announced that Madhu Kela is involved.

Identifying trustworthy, hardworking, motivated and knowledgeable management is crucial in any company, anywhere in the world. Madhu Kela and his team have decades of experience, and this provides them with invaluable insight into which management teams to back and which to avoid. With a 14-person investment team based in Mumbai, we have one of the strongest and most stable teams on the ground. Madhu Kela makes a point of staying in touch with management teams, even when we aren’t invested in their stock to keep the relationship alive and not purely on a transactional basis.

As in other international stock markets, earnings reports can be very important. Particularly positive or negative earnings surprises can be rewarded or punished accordingly. The extent of the reaction will also depend on a company’s starting position. If a company has been a serial disappointer and expectations are low, even a mildly positive number can lead to a dramatic improvement in the share price. Sometimes, just the fact that a company has stopped getting worse, can be taken very well by stock markets. In reverse, if a company is a stock market darling and issues a report that is merely very good rather than great, they can be punished. It’s also important to look beyond the numbers. The commentary that is provided by the company will also be scrutinised by investors. If a company delivers decent earnings numbers, and combines those with a highly optimistic outlook statement, the reaction can be much greater than the bare numbers would suggest.

In many ways, the way in which we would assess valuation in the Indian market is similar to how we would view value in any international market. This is important – it is always uncomfortable to be told that a particular market is expensive by every normal metric and can only be regarded as good value using one obscure yardstick, as was the case for decades during the Japan bear market.

Whilst not every metric can be applied to every company or sector (either in India or internationally), the way Madhu Kela looks at Indian companies would be entirely familiar to any international investor as they use a combination of PE, PCF, EV/ EBITDA, PEG ratio. They will also pay close attention to the assets of the business as these can provide either a margin of safety or a catalyst for value to be realised. They will also look at how any of these metrics appear versus local peers, international peers, and its own history.

Warren Buffett said that the best way to manage risk is to know what you’re doing. By owning a portfolio of companies that we have extensively due diligenced from multiple perspectives, we believe we know more about them than almost any other investor. We combine that with a margin of safety to give ourselves more far more upside than downside (which we call a “cork underwater”). This has been demonstrated in our performance. Out of the circa 100 stocks we have invested in since launch, there have been many that have delivered 3x, 4x, 5x+ and only a handful that have generated losses. Of the losers, only two have cost more than 1% of our NAV.

We like to invest either when good news is already starting to flow or where we can clearly identify that news flow is likely to change over the coming months. We do of course build diversified portfolios that have exposure to a number of different sectors, and this reduces the risk of an exogenous shock, but we don’t believe in managing tracking error as we fundamentally disagree with the idea of simply adding index heavyweight stocks for the sake of ballast. If an index heavyweight stock is expensive, deteriorating and has little margin of safety, we fail to see how it’s inclusion can reduce risk.

It is also important to differentiate between risk and volatility. Volatility is something that all investors must accept as part of being in any asset market around the world. No-one can predict when an exogenous event will occur and cause prices to move. We do not waste time trying to second guess whether a US Federal Reserve or OPEC announcement will push global markets or India up or down by a percentage point or two. To us, risk is the chance of a permanent fall in the value of one of our investments and this is why we devote so much of our efforts in testing how well we are protected on the downside. We look for well managed companies with open accounting, honest management, robust balance sheets and valuable assets, brand names and market positions that will always be attractive to corporate suitors.

Because of our clear distinction between risk and volatility, we choose to embrace the latter. If an investor doesn’t really understand a business, they may mistake volatility for risk and see a falling share price as a reason to sell before things get worse. If we are invested in fundamentally excellent businesses and volatility causes their share prices to fall, this can give us the opportunity to add to our holdings.

We do not manage our portfolio from the perspective of achieving a particular risk ratio as none of them reflect what we are trying to achieve nor how we think about risk. We do agree that investments should generate returns above those available risk-free and our whole philosophy is based on generating excellent strong absolute returns over any medium- term horizon. However, comparing that excess return with the fund's historic volatility is less useful in our view. Most risk/ reward measures use historic volatility as the definition of risk whereas to us, the real risk is the permanent loss of capital.

Nevertheless, we recognise that many investors are interested in risk/reward ratios and have worked recently with leading analytics firm Clarus Risk to identify aspects of our returns that may be illuminating. Perhaps the best-known risk/reward ratio is the Sharpe. Since launch, we have delivered a Sharpe of 1.22*, comfortably ahead of the MSCI India ETF (a common benchmark) Sharpe of 0.75*. Although our Sharpe would be considered good by any measure, we believe that the Sortino is a better reflection. The Sharpe treats both upside and downside volatility equally and punishes upward spikes. Upwards volatility should generally be welcomed by investors! We have regularly had such periods as shown below.

.jpeg)

This benchmark is presented for illustrative purposes only, as Cohesion MK Best Ideas does not have a designated benchmark.

The Sortino focuses on only downside volatility and is (at risk of arguing with a Nobel prize winner…), more representative of what we are seeking to achieve as it rewards capital preservation and upside volatility. Our Sortino since launch of 2.25* is close to double that of the MSCI India ETF and something we feel very proud of.

Our view of risk is a holistic one, that’s goes far beyond volatility. Sharpe says nothing about how a portfolio has been constructed and the risks that an investor is exposed to today. It cannot tell us about the liquidity, the cash generation, the margin of safety within individual companies, the likely news flow from the companies or the optionality in stocks. This is how we think about risk. We think about how we can deliver excellent absolute returns whilst minimising the risk of permanent capital erosion. Sadly, at any time, there are plenty of funds with excellent Sharpes that are a ticking time bomb of volatility that just hasn't arrived yet.

*Source: Clarus Risk Report; Data as on 30th April 2025.

We very deliberately chose not to give Cohesion MK Best Ideas a benchmark or performance comparator. Some fund managers are reluctant to show a benchmark because such a comparison will demonstrate their underperformance. That is not the case with our fund as we have comfortably outpaced Indian indices and peer groups since launch.

Our reason for not setting a broad index benchmark is that it risks changing behaviours. A fund manager who has to keep one eye on a benchmark may start thinking about tracking error. They might buy shares in companies that are badly managed, or which look expensive just to reduce their career risk. To generate the outsized returns, both absolute and relative, that we have posted requires us to have active positions. We have no interest in buying stodgy index heavy weights just to hug an index and that's why we don't spend much time looking at tracking error or the Information Ratio. We don't want our team to change a winning formula that has worked for decades. Similarly, we have no problem holding cash (which no index will hold) when we believe it is right to do so. We are also very willing to initiate positions in companies that we believe will deliver 5x, 10x or more but knowing that they may be volatile or underperform over the next few weeks or months. If we managed to a benchmark tracking error target, we may have to forgo some of these. When we have performed the most exhaustive due diligence on a company, taken soundings from all of their suppliers, customers, regulators and peers, identified margins or safety and optionality, does it really make sense to turn down massive upside (and ultimately a great return over the medium term) because of worries about short term relative performance

There is more than one mistake that can be typically made. We have seen some international investors simply buying a handful of index heavyweight companies and believing that this is enough to give them a flavour of India. Although they will probably do quite well over the very long term because of the momentum in India, they may well lose money over two or three years if they have bought the wrong heavyweight stock at the wrong price. Often, the biggest or even the best-known company is not the one that delivers the best returns. This can be the difference between a good company and a good

investment.

The other mistake commonly made is to take too much notice of the consensus view on a sector. Other investors can hold onto old biases for a long time and fail to appreciate that sectors have gone through a complete transformation. We love buying out of favour sectors that are cheaply priced and yet about to start delivering positive surprises.

Finally, it would be a mistake to try to manage an Indian portfolio without on the ground knowledge. Although there is a lot of information to be read about India and her largest companies, India is still an inefficient market and there is a lot of money to be made if you just know where to look and who to ask.

Investment horizons can and do change because economies and companies change. Although we will set ourselves a likely target price when making an investment, we do not operate in a bubble. We may set out with the intention of selling when we have doubled our money over a three-year period but if the share price rises by 50% in a few months, we may well take some money off the table. The public sector banks would be a good example of this. In another scenario, we might expect to double our money over three years but then find that the company performs so well that it continues to look cheap even after it has doubled its share price. RK Forgings would be a good example of this – its earnings have been rising as quickly as the share price and therefore it’s not become too expensive despite making us a lot of money.

Our agility is an important part of our investment process. We want to be the best Indian investor, not the biggest. Cohesion MK Best Ideas was built with a maximum capacity that is much smaller than many of our peers as we do not want to lose the nimbleness that allows us to not only have great ideas but to implement them.

Currency risk is a fact of life, wherever you’re investing in the world, even when investing in your own stock market. Even if you decide to stay entirely with domestic stocks, they are likely to be sourcing goods, paying wages and selling their products overseas, and therefore they will have currency exposure. In our portfolio, there will be a diversified basket of currency exposures, and therefore it is too simplistic to say that a weak rupee is bad for us. There will be companies in our portfolio that benefit from a weak rupee because it will make their exports cheaper overseas (or make their goods locally look more competitive against imports). Also, there will be companies that have hedged their own currency exposure or have offsetting currency exposures across their business. All these factors are taken into account when Madhu Kela and his team are looking at any investment.

We also believe that there are compelling reasons to believe that the rupee could be a positive contributor to USD or GBP investors over the coming years. With the Indian economy far healthier than many international peers across multiple measures and with demand for rupees likely to rise because of foreign investment, the outlook appears bright.

Emerging markets are not a homogenous group. Many emerging markets are exhibiting far less growth than India and much more volatility. An investor who bought an emerging market fund a few years ago may have done well from the fund’s small exposure to India but any upside from India would probably have been negated by poor returns from Russia, China and elsewhere.

Global emerging markets funds do not specialise in India, and they are generally managed by teams that have little or no presence on the ground in India. They are generalists, not specialists. The Indian market is very large, with nearly 8,200 listed stocks. A multi country fund manager can never really track and analyse enough of these properly, and hence, they can only look at the very biggest and most researched companies. Therefore, they cannot realistically expect differentiated returns consistently from any benchmark.

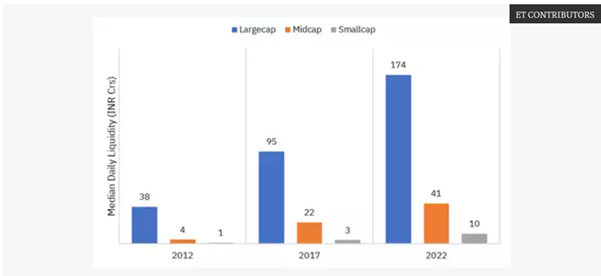

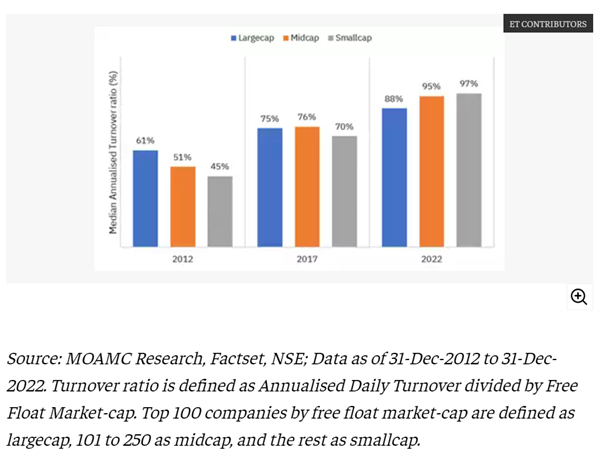

It’s important to remember that the Indian stock market is one of the largest in the world, and therefore it would be wrong to categorise it alongside micro emerging markets. The largest companies in India have very healthy daily average volumes and can be traded easily by us. As the graph below shows, liquidity has steadily and significantly improved across all market cap ranges in India over the last 10 years, rising circa 10-fold in mid and small caps and 5- fold in large caps. There has also been a steady increase in the turnover rate across the market cap spectrum.

Having said this, it is fair to acknowledge that liquidity falls as you go down the market cap scale, just as it does in every stock market internationally, but can provide opportunities. Every day there are investors trying to sell perfectly good companies and facing their own illiquidity squeezes and this can allow us to pick up attractive lines of stock at bargain prices. We often maintain cash balances of 10% to 15% in the portfolio to allow us to pick up these distressed sales. Often, we will identify a sector and specific investment opportunities ahead of the market, and when we have made our money and are ready to sell, the market demand will have caught up and there will be a stream of willing buyers. We have seen this many times in the past. It’s also worth remembering that we have deliberately set out to keep this fund at a manageable size. If we changed the marketing strategy and sucked in many billions of dollars of assets, Madhu Kela might be unable to take advantage of the trading opportunities. We measure our success by the returns provided to investors, not by AUM growth.

Cohesion is the authorised fund manager and is ultimately responsible for all aspects of it, including the investment performance. Cohesion benefits from a management team of experienced asset management professionals, each with more than 30 years of direct relevant experience gained in some of the world’s leading asset management businesses. This experience allows us to support and also challenge Madhu Kela and his team and regularly assess the performance against relevant indices and peer groups. In doing so we look at the performance not only in terms of the absolute returns that it has generated, but also the risks that it has taken to do so.

Cohesion’s capability is knowing how to make money for investors. We provide access to superior growth. We identify growth in a world where growth is scarce.

Cohesion identified India as the most predictable growth theme with decades of visibility. In order to get the very best from the opportunity that India provides, we wanted to partner with the most successful fund manager. We had known Madhu Kela for many years, and we were delighted to form a partnership with Madhu Kela and his investment team colleagues. Spike Hughes and Madhu Kela have a shared passion and dedication that puts investors at the heart of everything we do.

Cohesion Asset Management Limited is the Investment Manager with all regulatory responsibility. Cohesion MK Best Ideas, as the investment vehicle, is managed as a joint venture between Spike Hughes and Madhu Kela with our teams each focusing on the areas in which we have the greatest experience and knowledge.

An important part of our investment process is the global reach that Cohesion brings. In an increasingly global marketplace, it is valuable for Madhu Kela and his team to discuss trends with successful international investors and business leaders that we know well. This, combined with unrivalled local access and knowledge of India, provides an extra lens on all investment opportunities.

The senior Cohesion team have invested substantial personal assets directly into Cohesion MK Best Ideas.

As an India-domiciled investor, Madhu Kela and his team are not allowed to invest in an international fund. These laws apply to all Indian-domiciled individuals. In order to align as closely as possible, Madhu Kela has gone on record stating that he has more than $100m of stocks that closely mirror the holdings in Cohesion MK Best Ideas. He has also put in place clear rules to prevent any conflicts of interest. Whenever such potential conflicts have arisen, Cohesion MK Best Ideas has been given preference in securing tight lines of stock and is put ahead of any personal dealing whenever we are looking to trade.

Madhu’s alignment to Cohesion MK Best Ideas goes well beyond just formal processes. It is based on the partnership that he has built with Spike and Cohesion over 15 years of business and friendship. Having enjoyed such an exceptionally successful career, he wants to work with people who are doing the right things for the right reasons and with a common vision. Cohesion MK Best Ideas has been built exactly to that vision.